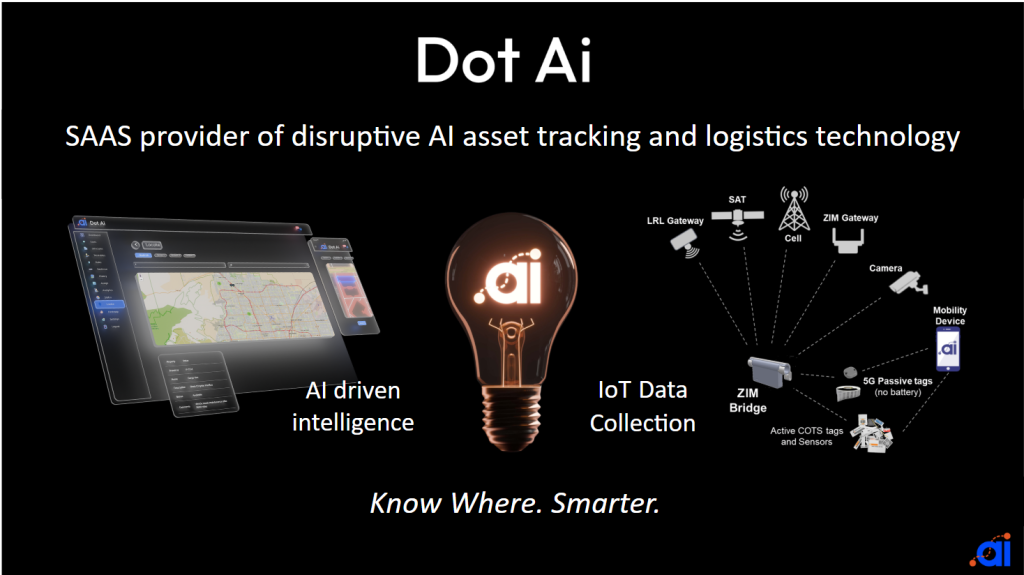

TLDR: The rapidly evolving $3.5 trillion Industrial Logistics and Asset Management market creates a massive opportunity for Dot Ai’s next-gen AI-powered platform. Dot Ai offers disruptive logistics and asset tracking solutions, combining patented asset and workflow management technologies to deliver real-time, actionable insights. With $4.2M in bookings in 2024 and early enterprise traction, Dot Ai is poised for substantial growth. Dot Ai’s experienced management team and proven patented technology, coupled with early traction with enterprise customers like Wurth, suggest a clear path to market leadership.

Why Dot Ai

Dot Ai’s impressive early market traction, driven by disruptive, patented asset and workflow management technology and AI-driven actionable insights. The company already boasts significant traction with enterprise customers, including a major partnership with Wurth that could generate $1B in revenue over the next 5 years. Additional customers such as Rooms 2 Go, Wagner Warehousing, and the U.S. Air Force are progressing toward adoption.

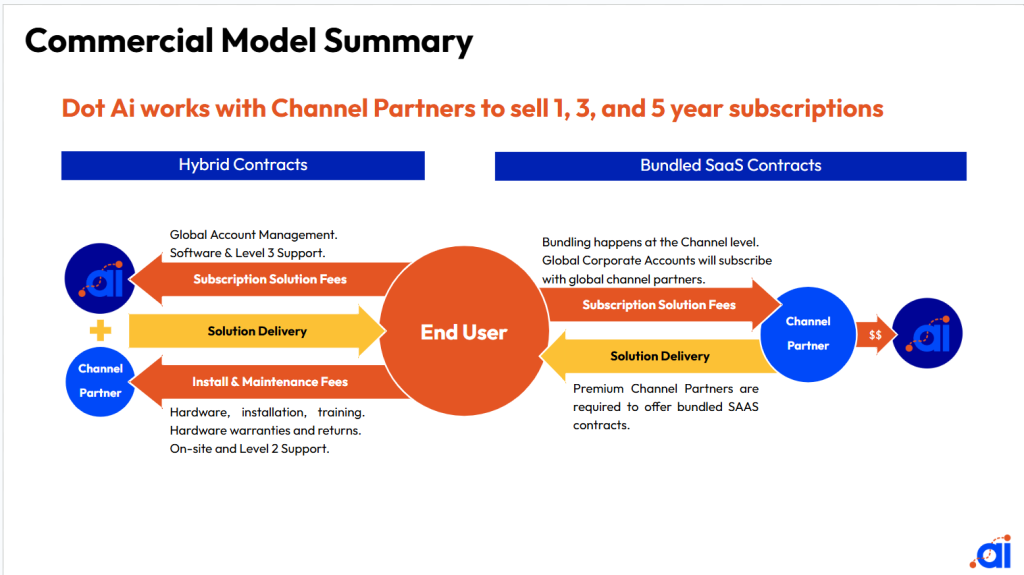

Dot Ai operates with a Capex-light, scalable SaaS business model. It combines passive asset-tracking hardware, some of which is built to purpose in its own factory in Puerto Rico, with real-time workflow management and actionable insights driven by proprietary AI technology. Dot Ai addresses significant inefficiencies in legacy asset management solutions, offering unprecedented speed and accuracy.

Investment Highlights

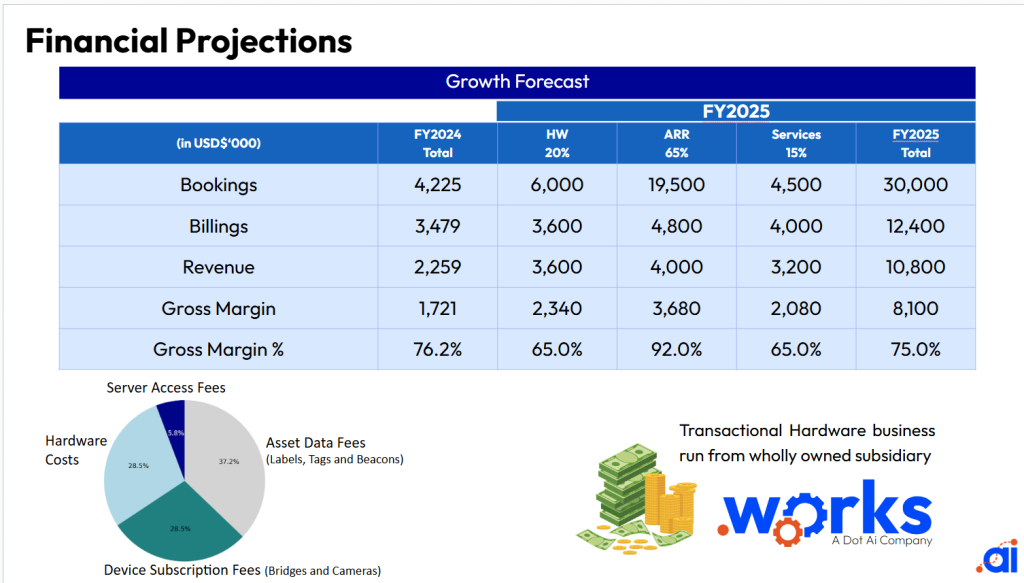

- Projected rapid revenue growth from a strong base of $2.2M revenue and $4.2M bookings in 2024.

- Patented technology integrating asset and workflow management, leveraging real-time AI insights.

- Robust initial market validation through large enterprise customers, highlighting substantial expansion potential.

- Proven leadership team with deep technical, operational, and industry-specific expertise.

- Significant competitive advantage through revolutionary speed of implementation (1-3 months versus industry average of 1-3 years).

- Organic growth strategy supported by a Capex-light model with high scalability and recurring SaaS revenue streams.

Market Opportunity

The global logistics and asset management industry is undergoing a transformative shift, driven by advances in AI, IoT, and cloud computing. Dot Ai’s platform is uniquely positioned within a $3.5 trillion market, addressing a serviceable available market (SAM) of $32 billion and an immediate serviceable obtainable market (SOM) of $3.6 billion. With its disruptive technology and rapid deployment capabilities (1-3 months vs. competitors’ 1-3 years), Dot Ai is well-positioned to capture substantial market share rapidly.

Business Model

Dot Ai’s SaaS-based revenue model involves subscription fees combined with asset-tagging hardware, yielding high-margin, recurring revenue. Their patented, device-agnostic AI platform simplifies asset management and optimizes workflow in real-time, significantly reducing operational inefficiencies and implementation timelines (from 1-3 years down to 1-3 months).

Competitive Advantage

Dot Ai differentiates itself from competitors through patented AI-driven real-time data collection, actionable intelligence, and a dramatically simplified asset management ecosystem. Unlike competitors with fragmented solutions requiring significant infrastructure investments and lengthy deployments, Dot Ai’s solution is streamlined, rapidly deployable, and scalable.

Risks

- Adoption Pace: Customer transition from legacy systems to an innovative AI-driven platform may vary.

- Competitive Environment: Established competitors and new market entrants could create competitive pressure.

- Scaling: Achieving rapid growth requires meticulous execution in operations, sales, and customer success.

- Technological Execution: Reliance on ongoing technological innovation and execution could impact projected growth.

Disclaimers

This webpage contains forward-looking statements that reflect the current expectations and views of management regarding future events. Such statements involve known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially. Investors should not rely solely on these statements

The information provided here is for informational purposes only and does not constitute investment advice, an offer to sell, or a solicitation to buy securities.

Investing in securities involves substantial risk, including possible loss of principal. Investors should perform their own due diligence and consult financial, legal, or tax advisors before making investment decisions.

The solicitation of investments on this page is intended to help meet NASDAQ’s minimum round lot holder listing requirements. These requirements ensure liquidity and investor protection. There is no guarantee that these conditions will be satisfied or that the shares will achieve or maintain their value.

Past performance does not guarantee future results. No representations or warranties are made regarding future performance.

Securities discussed herein may not be offered or sold unless registered or exempt from registration under applicable securities laws.